reverse sales tax calculator ny

Sales tax applies to retail sales of certain tangible personal property and services. New York is generally known for high taxes.

Reverse Sales Tax Calculator Calculator Academy

OP with sales tax OP tax rate in decimal form 1 But theres also another method to find an items original price.

. Current HST GST and PST rates table of 2022. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Before-tax price sale tax rate and final or after-tax price.

You can use this method to find the original price of an item after a. Reverse Sales Tax Calculator. Or to make things even easier input the NYC minimum combined sales tax rate into the calculator at the top of the page along with the total sale amount to get all the detail you need.

Here is how the total is calculated before sales tax. Reverse sales tax calculator ny Sunday June 12 2022 Edit. Tax can be a state sales tax use tax and a local sales tax.

TAX DAY NOW MAY 17th - There are -409 days left until taxes are. New York City Sales Tax Rate And Calculator. Reverse Sales Tax Calculations.

Sales Tax For Small Businesses. New Jersey State Tax Quick Facts. How To Find The Amount Of Sales Tax A handful of states have a set handful of days each year that are designated as sales tax holidays.

Sales tax calculator to reverse calculate the sales tax paid and the price paid before taxes. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original. Sales taxes for a city or county in New York can be as high as 475 meaning you could potentially pay a total of 875 sales tax for a vehicle in.

The Impact Of Hybrid Work On Commuters And Nyc Sales Tax Office Of The New York City. Enter the final price or amount. New York on the other hand only raises about 20 percent of its revenues from the.

Overview of New York Taxes. View all NYC NYS Transfer Tax rates including the higher rate for commercial and 4-or-more family homes here. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

New York Sales Tax Calculator Reverse Sales DrEmployee. 242 average effective rate. New York City Sales Tax Calculator.

View our Williams Toyota of Elmira inventory to find the right vehicle to fit your style and budget. Reverse Sales Tax Calculator to calculate price before tax and the tax amount based on the final price and sales tax percentage. Our free online New York sales tax calculator calculates exact sales tax by state county city or ZIP code.

Rather than calculating sales tax from the purchase amount it is easier to reverse the sales tax and separate the sales tax from the total. New York has a 4 statewide sales tax rate but also has 640 local tax jurisdictions. How To Find The Amount Of Sales Tax.

3078 - 3876 in addition to state tax Sales tax. Here is how the total is calculated before sales tax. The recently enacted New York State budget suspended certain taxes on motor fuel and diesel motor fuel effective June 1 2022.

And several of these states raise nearly 60 percent of their tax revenue from the sales tax. Instead of using the reverse sales tax calculator you can compute this manually. Use this app to split bills when dining with friends or to verify costs of an individual purchase.

Multiple the pre-tax value by the newly calculated decimal value in order to find the cost of the sales tax. Content Small Business Sales Tax. If the purchase comes to 100 the sales tax in New York City would be 850 100 x 00850.

The only thing to remember in our Reverse Sales. Sales tax amount or rate. That entry would be 0775 for the percentage.

Sales tax total amount of sale x sales tax rate in this case 8. Example Question 7. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

From there it is a simple subtraction problem to figure out that you paid 61 cents in sales tax. Add the sales tax value to the pre-tax value to calculate the total cost. The harmonized sales tax or hst.

Just enter the five-digit zip. New York Income Tax Calculator - SmartAsset Find out how much youll pay in New York state income taxes given your annual income. Depending on the zipcode the sales tax rate of New York City may Find your GSTHST rebate for a new home.

Add The Sales Tax To The Sale Price. Reverse Sales Tax Calculations. New York has a 4 statewide sales tax rate but also has 640 local tax.

Amount without sales tax GST rate GST amount. On March 23 2017 the Saskatchewan PST as raised from 5 to 6. Last create a proportion where the pre-tax value is proportional to 100 and solve for the percentage of sales tax.

The current total local sales tax rate in Montrose NY is 8375. See the article. Amount without sales tax QST rate QST amount.

To find the original price of an item you need this formula. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737. To calculate the amount of sales tax to charge in New York City use this simple formula.

Sellers pay a combined NYC NYS Transfer Tax rate of 2075 for sale prices of 3 million or more 1825 for sale prices above 500k and below 3 million and 14 for sale prices of 500k or less. For more detail that may include local tax rates or type of purchase you need to consider see Wikipedia Tax Tables by State. Reverse sales tax calculator ny Sunday June 12 2022 Edit.

Reverse sales tax calculator ny Monday March 7 2022 Edit. This is the amount that the government will collect in taxes on. Use tax applies if you buy tangible personal property and services outside the state and use it within New York State.

Ad Calculate your tax refund and file your federal taxes for free. You can use our New York Sales Tax Calculator to look up sales tax rates in New York by address zip code. Us Sales Tax Calculator Reverse Sales Dremployee A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

Reverse Sales Tax Calculator. For example if the full payment is 5798 and you paid 107 sales tax you can enter these numbers into our calculator to determine your original pre-tax price. Tax rate for all canadian remain the same as in 2017.

75100 0075 tax rate as a decimal. For a married filer with a combined annual income of 130000 in New York City the. New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status.

Tax Title and Tags not included in vehicle prices shown and must be paid by the purchaser. For a state by state table of sales tax rates for 2022 see State and Local Sales Tax Rates 2022. Start filing your tax return now.

How To Calculate Charge And Pay It Forms And Instructions Step 5 Record The Sales Tax Liability Company Example Question 7.

How To Calculate Sales Tax Backwards From Total

Reverse Sales Tax Calculator Calculator Academy

Reverse Sales Tax Calculator Calculator Academy

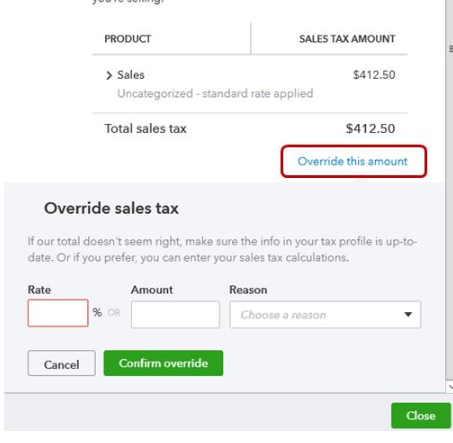

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

New York Sales Tax Calculator Reverse Sales Dremployee

Sales Tax Recovery Reverse Sales Tax Audit Pmba

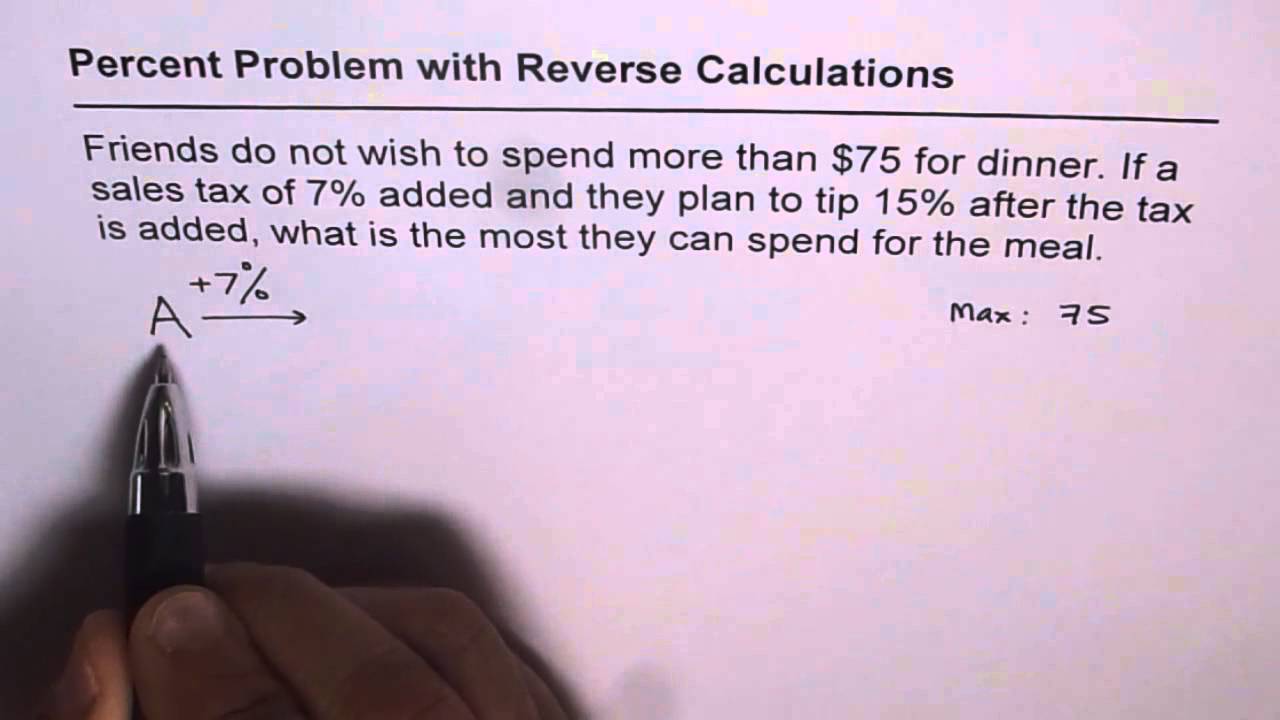

How To Calculate Amount With Percent Tax And Tip With Reverse Calculations Youtube

Reverse Sales Tax Calculator 100 Free Calculators Io

How To Calculate Sales Tax In Excel Tutorial Youtube

Reverse Sales Tax Calculator De Calculator Accounting Portal

How To Calculate Sales Tax Backwards From Total

Reverse Sales Tax Calculator 100 Free Calculators Io

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

State Corporate Income Tax Rates And Brackets Tax Foundation

Stripe Tax Automate Tax Collection On Your Stripe Transactions

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com